A Practical Guide for Adult Children (+ SSI/SSDI Basics)

For adult children navigating a parent’s health decline or long-term care needs, it often feels like you’ve been thrown into the deep end without a life jacket. From finding the right kind of care, to figuring out how to afford it, while also managing your own life and responsibilities; the process can be overwhelming, confusing, and urgent.

That’s where CareAvailability.com and Liner Legal come in.

CareAvailability.com gives you real-time access to senior care options across the care spectrum, so you can find trusted, available providers in your area right when you need them most.

Liner Legal is one of the nation’s leading disability law firms helping individuals and families understand if they (or their loved ones) qualify for SSI or SSDI benefits that can help cover essential costs, from medical care to daily living support.

Together, we’re here to help you plan smart, act early, and advocate like a pro.

“Families are often stuck playing detective, trying to figure out what Medicare will cover, whether their parents qualify for disability benefits, and where to turn for help. Our mission is to remove that burden and be your guide.” – Michael Liner, Esq., Founder & Head Attorney at Liner Legal

7 Smart Steps to Take When Planning Care for a Parent

1. Define Today’s Care Needs (and Tomorrow’s)

Start by assessing what your parents need now, and anticipate what they might need in 30–90 days. Use Care Availability’s platform to compare:

- In-home care vs. assisted living

- Memory care vs. skilled nursing

- Respite care vs. long-term placements

Pro Tip: Ask any provider, “What signs should I watch for that indicate the need for a higher level of care?” This proactive approach helps avoid crises.

2. Understand What Medicare Covers (And What It Doesn’t)

Many families are surprised to learn:

- Medicare does NOT cover long-term custodial care, like assistance with bathing, dressing, or cooking in an assisted living facility.

- It does cover short-term skilled nursing or home health care when medically necessary, but only under strict guidelines.

“One of the most costly misunderstandings is assuming Medicare will cover everything. Knowing what it doesn’t cover is the first step in building a sustainable care plan.” – Michael Liner

3. Time Your Planning Around Key Dates

- Medicare Open Enrollment runs October 15th – December 7th which is ideal for reassessing plans if your parent’s health or care needs have changed.

- Social Security COLA (cost-of-living adjustment) is announced in October. This can affect income eligibility for SSI and help with budgeting.

Consider using family-focused observances to start conversations, like:

- Grandparents Day (September 7th)

- Falls Prevention Awareness Week (September 22–26th)

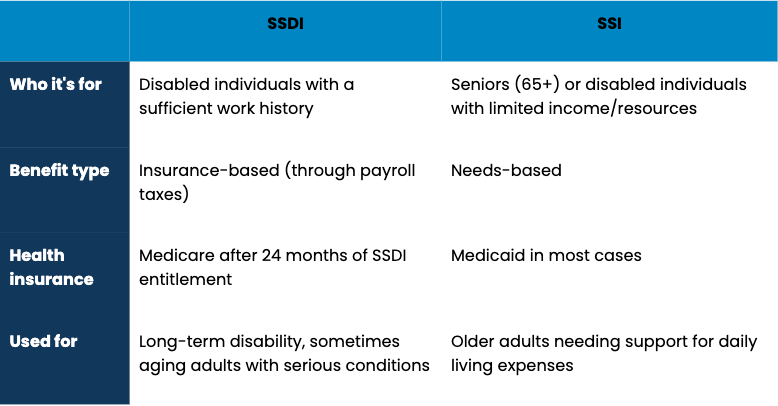

4. Learn the Basics: SSI vs. SSDI

Bonus Tip: If your parents left the workforce early due to a health condition, even years ago, they may still qualify for SSDI.

5. Build a “Family Care File”

Having documents ready can prevent delays:

- Medicare/Medicaid/insurance cards

- Social Security statements

- Advance directives / power of attorney

- Medical records and medication history

- Legal paperwork

- A care comparison worksheet from Care Availability

- An SSI/SSDI eligibility checklist from Liner Legal

6. Know the Warning Signs You May Need Legal Support

If any of the following apply, it’s time to talk to a disability lawyer:

- A parent stopped working because of illness or injury

- You’re unsure how to afford long-term care

- A previous disability claim was denied

- You want to understand your parent’s eligibility for SSI or SSDI

Liner Legal provides free case reviews, and you don’t pay unless they win the case.

7. Don’t Navigate This Alone. Let Experts Guide You!

Between comparing care providers, filing paperwork, and researching benefit programs, it’s easy to feel lost. But with the right partners, you can move from overwhelmed to empowered.

Next Steps:

- Search care options now at CareAvailability.com

- Take this 2 minute survey to find out if you or your parent may qualify for SSI or SSDI benefits.

One thought on “Senior Care Planning for Your Parents”

elizabeth_ says:

Love this informational article and collaboration!